Amid the development of more highly refined alternatives, Group I “bright stock” remains the preferred base oil of choice for certain applications today.

A heavy, high-viscosity oil that is typically refined through a simple and inexpensive process, bright stock continues to perform well in heavy-duty and industrial applications.

But, as we know, supply has been declining over the years. And new regulations written to mitigate sulfur oxide emissions are creating added pressure to find alternatives.

Is now the time to move on from bright stock? That depends.

While the necessity to find Group II alternatives may prove inevitable, timing depends a great deal on your industry, unique business needs, and readiness to explore new products.

Bright Stock’s Place in the Base Oil Market

Bright stock – the classic high-viscosity, slow-pouring, amber-colored base oil – has been around since the 1930s. The hydro-treating process developed in the 1960s added the stability and longer life that we associate with Group I oils today.

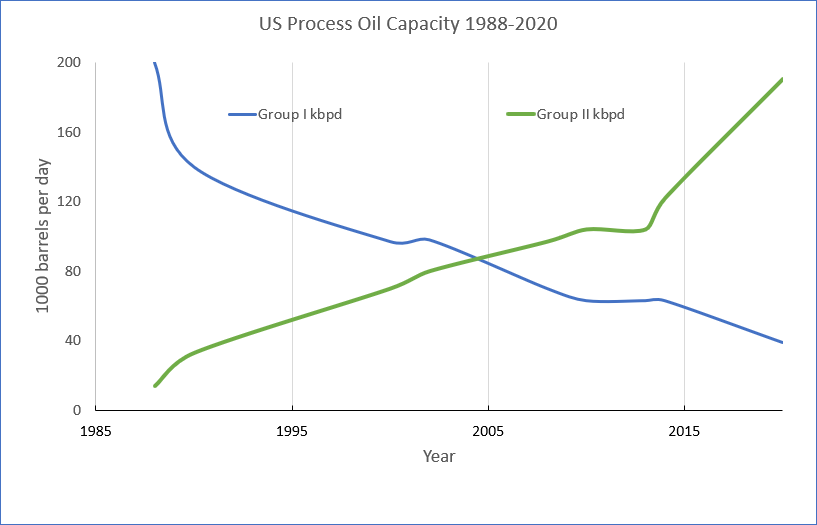

Traditional Group I refining has been rapidly displaced by high severity, catalytic Group II refining.

Since the 1970s, blenders have seen the base oil market continually evolve. Compared with bright stock:

- Group II oils have offered reduced sulfuric content, improved resistance to oxidation, more stability, fewer impurities, and clearer – nearly colorless oils.

- Group III oils are further refined and provide lower viscosity but even higher performance.

- Group IV synthetics have offered additional purity and higher viscosity.

- Group V oils and additives, including naphthenics, some esters, and silicones that have been commonly used since the 1940s, have further broadened the field.

Many blenders have transitioned to these Group II and higher base oil options over the years to achieve greater technical performance or to satisfy emissions standards.

But for other applications, bright stock’s high viscosity offering remains the preferred base oil over more severely refined and sometimes higher-priced alternatives. These include, but aren’t limited to:

- Industrial greases

- Gear oils

- Two-stroke marine engine lubricants

- Extension oil for some rubber products

Given the ongoing worldwide trend toward advancing quality and yield, how long bright stock remains the base oil of choice for these industries is an open question.

Is It Time to Rethink Bright Stock?

The trend toward replacing Group I with Group II and III base oils has progressed steadily for decades. Much of this has been driven by the automotive industry, which has continually pushed for higher thermal/oxidative stability and better fuel economy from lower viscosity oils.

Some signs point to that trend accelerating.

Among the most significant is IMO 2020, the International Maritime Organization’s new limit on sulfur content in fuel oil. Marine fuels used in certain zones must contain no more than 0.5 percent m/m (mass by mass). This is a significant reduction from the previous limit of 3.5 percent.

As the seafaring industry transitions to IMO 2020-compliant, Group II/III oils, it will represent a significant drop in worldwide demand for bright stock. This may be the tipping point that accelerates Group I plant closures, subsequent drop in supply, and further limiting of availability.

Thoughtfully Exploring Group I Base Oil Alternatives

Replacing bright stock is not as simple as turning to any alternative high-viscosity fluid. For some applications, you either need to find a base oil that is polar enough to achieve the same degree of solvency, or stick with bright stock until you do. For other applications, the solvency and viscosity are not critical and Group II oils, like Chevron’s 600R, perform well.

Today, Chevron offers some of the top contenders for Group II base oils that, with the right formula, can achieve comparable or better performance to bright stock economically.

The following product lines offer heavy-duty performance while meeting numerous European, Japanese and North American specifications, including those established by ILSAC, ACEA and OEMs.

Chevron Group II

Long associated with PCMO and heavy-duty motor oils (HDMO), Chevron brand Group II/Group II+ products provide a high-performing base for industrial oils as well.

In some applications, the purity and oxidation stability of Chevron’s Group II base oils can boost performance significantly. In those cases, replacing Group I base oils with Group II can extend oil life by as much as 300 percent.

NEXBASE Group III

Developed by Neste and acquired by Chevron in 2021, the NEXBASE line includes low- to medium-viscosity base oils used for formulating compressor, hydraulic, turbine, transmission, and gear oil products.

These base oils offer greater fuel economy, lower emissions, and excellent volatility ideal for industrial applications.

Group I Availability

If you’re not yet ready to explore bright stock alternatives, it’s early yet to worry too much about availability.

It’s true that both supply and demand for bright stock have dwindled. But industry experts have observed that as of the end of 2021 supply has pretty well kept pace. In other words, there’s “still plenty out there” for those who need it, according to Lubes ‘n’ Greases.

That said, it’s as important to meet your present needs as it is to keep an eye on future trends. Working with the right supplier will help you do both.

At Renkert Oil, we’re more than suppliers. We’re a team of consultants. Problem solvers. As we continue to help bright stock buyers like you source Group I base oil amidst the shifting market, we can also help you find affordable, high-performing, sustainable alternatives.

The way the winds are blowing, the need to transition away from bright stock will likely be inevitable in the not-too-distant future. It’s at least time to have the conversation.