Early in the second quarter of 2022, we examined where oil prices might be headed and the downstream effects on specialty oil suppliers and customers. It appears we have good news.

To briefly recap where we’ve been:

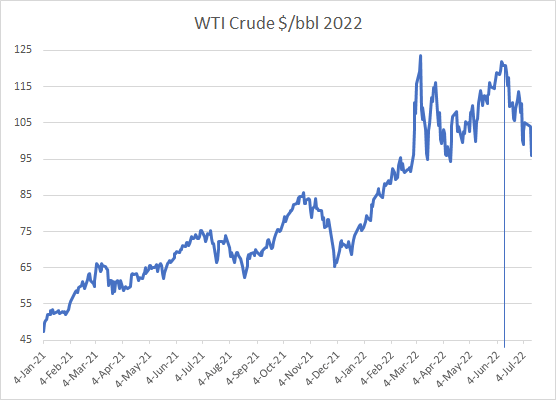

- Crude oil prices increased by nearly 60% throughout 2021, reaching an annual average of $68/barrel, the highest in three years, with a peak of $86/barrel.

- The Russian invasion of Ukraine in late February 2022 throttled supply, causing the spot price of West Texas Intermediate (WTI) to shoot up well above $100/barrel.

- As of April, gasoline prices, which had already been on the rise, were climbing still higher, setting a new U.S. record when the average cracked $5/gallon in June.

In April, we looked at analysis of what the rest of the year might have in store. As pricing pressures were intensifying, would crude oil prices continue to rise, or was a decrease in store?

Now, at the start of the third quarter, prices appear to be falling.

But have we really reached the top of the pricing spiral? Can specialty oil suppliers, customers, and consumers expect some relief?

Let’s see what analysts are saying now.

Oil and Gas Prices in Early July 2022

For many, the sharp one-day decline in crude oil prices on July 5th, 2022 was welcome news.

The drop of nearly 10 percent was the most dramatic sign yet of a downward trend. Prices were around $120/barrel in mid-May. On July 6th, WTI was trading below $100/barrel for the first time since early May.

This was certainly good news for consumers, as gasoline prices fell another two cents to $4.779 per gallon, part of an overall drop of 24 cents per gallon since the high of $5.016 per gallon in June. GasBuddy predicts a decline of another 40-65 cents in the weeks ahead.

Gasoline is often cited as a barometer of the oil and gas industry, but what does all this really mean for specialty oil suppliers? What should customers expect?

Specialty Oil Suppliers: Will We See Pricing Pressure Decrease?

Back in April 2022, analysts were divided (as they tend to be). And as it turns out, they’re even more divided now.

In the second quarter:

- Signs pricing pressure could increase through the year included sanctions on Russia, global supply disruption, and OPEC+ struggling to revive output, all while demand for energy was expected to remain constant.

- Signs we might see a decrease included a belief that the oil rally was too steep to sustain, the historical tendency for higher prices being themselves “the cure” for high prices, betting on OPEC+ to catch up, etc.

Now, at mid-2022, the predictions range from crude oil dropping to an average of $65/barrel to reaching a whopping $380/barrel. (No, that is not a typo.)

- Before the holiday weekend, JPMorgan sided with those predicting further increases, predicting crude oil would reach a “stratospheric” $380/barrel “if U.S. and European penalties prompt Russia to inflict retaliatory crude-output cuts.”

- But on July 5th, Citigroup joined the decrease camp by predicting crude prices would collapse to $65/barrel, perhaps dropping as low as $45/barrel by the end of 2023.

Good News and Bad News

If the likes of Citigroup are correct, this would spell good and bad news for specialty oil suppliers and customers.

The good news is that a price drop of this degree, if sustained, is enough to have deeper downstream effects beyond the initial market reaction of reduced gasoline prices. Specifically, it should alleviate pricing pressure on refineries, suppliers, and customers.

The bad news is that the most significant price drop predicted will likely accompany a global, “demand-crippling recession.”

“For oil, the historical evidence suggests that oil demand goes negative only in the worst global recessions. But oil prices fall in all recessions to roughly the marginal cost,” Citi analysts said in a note.

In other words, a price drop is only good news to a point. A quick collapse of crude oil is likely a sign that the condition of the world economy is worsening.

How bad could the expected recession be here in the U.S.? According to some economists, not too deep (relative to other national economies) but far too long for comfort.

According to Robert Dent, the senior U.S. economist at Nomura Securities and former New York Fed analyst, we can expect a contraction of roughly two percent that begins in the fourth quarter and lasts through 2023.

Effects on Specialty Oil Suppliers, Lubricant Suppliers

Historically, markets for base oils and other petroleum derivatives like white mineral oil have a slower response to variation but do move as the trends stabilize at higher or lower averages.

The refineries we work with set responsible prices that anticipate these changes and avoid short term volatility seen in fuels. However:

- If pricing shoots back up, a sustained cost spiral may yet force refiners to increase pricing floors, which would mean downstream effects on specialty oils and lubricants.

- But if they can expect a sustained pricing decline, they’re likely to return these floors to their pre-spiral levels to keep their pricing competitive.

If the more optimistic forecasts bear out, pricing has finally leveled out and could even fall, preventing further increases in specialty oils.

Of course, other pricing pressures remain, such as rising inflation and transportation costs. But let’s not neglect to note the good news as it comes: a 10 percent one-day drop in crude prices is certainly worth celebrating.

More than Specialty Oil Suppliers, Renkert Oil Helps You Contain Costs

Renkert Oil is an experienced specialty oil supplier helping a wide variety of product manufacturers navigate these challenges with cost containment solutions.

These are a just a few examples of the industries we serve and some of the products they rely on:

- Automotive and Industrial Oil Manufacturers – base oils, rubber process oils

- Food Manufacturers – food-grade white mineral oils

- Power Suppliers and Operators – electrical insulating oils/transformer oils (T-oils)

- Agricultural and Household Product Manufacturers – carrier oils, solvents, grain & feed dedust oils, paraffinic spray oils, fertilizer dust control

- Rubber, Adhesives, Sealants, Insulation – extender oils/process oils

- Household and Sports Equipment – cleaning & polishing products, fragrance carrier oils, soft-touch TPE extenders, gel components

Consider us a key partner in reliable supply, logistics, and product consultation. Given all the volatilities in this market today, we address the possibilities of:

- Specialty oil alternatives that are more cost-effective

- More economical formulations that don’t sacrifice product quality below established standards

- Shorter, more diverse supply chain strategies that could reduce your transportation costs and/or costs associated with supply insecurity

Whatever your specialty oil needs, these are the conversations you need to be having with Renkert Oil, experts in this industry for four decades.