The war in Ukraine is affecting the global economy in countless ways, with the full extent of its impact on our specialty oil customers yet to be seen.

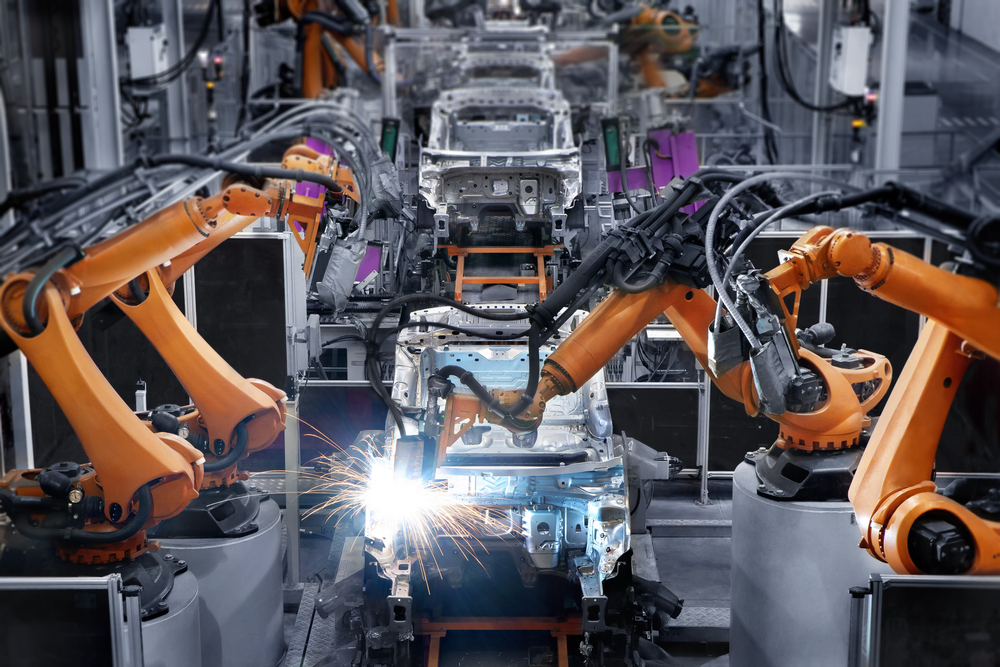

One of the most visible impacts happening now is on the automotive industry, a significant end user of our products.

We all know the pain automakers and their suppliers are feeling now isn’t limited to their sector. This story is really about the far-reaching effects of the Russian invasion on the global supply chain on which we all depend.

How the War in Ukraine is Affecting Automakers

The automotive industry was already hurting before Russia launched its invasion campaign on February 24, 2022. Like so many others, the sector was still reeling from ongoing pandemic-related supply chain issues.

Pinched production during the pandemic bottlenecked supply of new and, by extension, the inventory of used cars. The extent of the pinch was reflected in dramatically rising prices in the U.S.

On average, from February 2021 to February 2022 (U.S.):

- Price of new cars rose 12%

- Price of used cars rose 41%

- Transaction price of a new car rose $10,000 (to over $46,000)

Now, what could have been a turnaround year is expected to remain tough on consumers, automakers, and their supplier ecosystem. The war in Ukraine is expected to reduce global production by millions of units, further tightening supply.

Many factors are driving this. We’ve highlighted just four of the most pressing on the minds of our customers supplying the automotive industry.

1. Tightened oil and gas supply.

Automakers in the U.S. and the United Kingdom will face many direct and indirect challenges stemming from bans on Russian oil and gas imports.

Prior to the ban, Russian crude has accounted for:

- 8% of U.S. imported oil

(20% of total supply is imported)

- 12% of U.K. imported oil

(about half of European countries import most of their oil)

The U.K. will feel the pinch more than in the U.S. The U.S. imports about a fifth of total supply compared with European countries, which are much more reliant on imports. But on both sides of the Atlantic, consumers are expected to face rising gasoline (petrol) prices.

This may have an impact on sales of gasoline-fueled vehicles, though historically, spikes in gas prices have not affected demand much.

More pressing are the direct impacts on the supply side, such as reduced supply of other crude oil byproducts used in the production of automotive parts.

A prime example is process oils used in the production of thermoplastic, rubber and EPDM moldings for automotive interiors and engine gaskets. As Russian producers of crude are cut off from the rest of the world, suppliers face new challenges in sourcing derivatives.

For comparison, a similar effect is already playing out in the natural gas supply chain. Natural gas is another major Russian export used to make a variety of plastics. Some plastics makers are making dramatic cuts in production as raw material plastic pellet shipments have been cut off.

Automotive parts makers are working hard to reorganize supply chains to bypass Russia. In the meantime, the road back to supply stability may remain bumpy. (Though having the right supply partner can make a critical difference – more on that below.)

2. Wire harness supply shortage.

Western Ukraine, where the capital of Kyiv is located, is a major supply region for wire harnesses. This is a crucial production step used to organize miles of vehicle wires and cables.

Suppliers there have been forced to shutter their operations and cut production. This is a blow to automakers who have been increasingly dependent on the region.

22 automotive companies have invested more than $600 million in 38 plants there.

At least one major supplier, Aptiv, began moving operations out of the country before the war in Ukraine began. Even so, major disruptions in production are inevitable.

3. Soaring cost of metals.

In addition to oil and gas, Russia has also been a major exporter of key automotive metals, such as:

- Aluminum, used in bodywork

- Palladium, used in catalytic converters

- Nickel, a key conductive metal for EV batteries

Costs are rising rapidly for these essential raw materials as Russian sources have been cut off from the global market.

This represents a significant challenge for metal fabricators who are asking automakers to pay more, forcing them to pass these costs on to the already price-shocked consumer.

That’s what Andreas Weller, CEO of Michigan-based Aludyne, has had to do in response to a 60 percent rise in the cost of aluminum.

“Some are more understanding and cooperative than others,” Weller said of his automaker customers’ responses, “but we cannot survive without that [price increase].”

This is one of the most significant signs that, at least in the short term, Russia’s war in Ukraine means that consumer vehicles are only going to get more expensive.

4. Loss of the Russian market.

The most significant shock to the demand side is in Russia itself, as many automakers have ceased exports to the country and operations within its borders.

Some have done so in protest of the invasion of Ukraine. Others would continue to serve the people of Russia, but logistics issues along Ukrainian supply routes make doing business there unfeasible.

These are just a few examples among several automakers that have taken action:

- Nissan suspended vehicle exports to Russia.

- Toyota has halted production at its Russian factory and ceased vehicle imports.

- Ford Motor has suspended all operations in Russia in protest.

- Honda has halted exports of cars and motorcycles to Russia, also in protest.

Though no doubt principled, these are difficult decisions to make for automakers and other industries with Russian interests.

This is particularly true of companies like Renault, Hyundai and Volkswagen, whose shares of Russian vehicle production are large: 39.5 percent, 27.2 percent and 12.2 percent, respectively.

Nevertheless, Renault suspended production at its assembly plant in Moscow due to “logistic issues” causing component shortages.

The tragedy is that these logistical problems hurting automakers, and the Russian communities they support, are created by Russia itself. The damage isn’t limited to Vladimir Putin’s targets in Ukraine.

In an interconnected, global economy, everyone feels the pain.

Our Focus on Supply Security as the War in Ukraine Continues

There’s no telling what additional logistics challenges automakers, auto parts makers, and their suppliers will face as the war rages on. Or even after it’s over.

Whatever lies ahead, Renkert Oil is ready to face the challenge for our customers serving these and many other industries.

We’ve spent the last four decades building an intercontinental network of partnerships, production terminals, storage facilities, supply routes, and redundancies.

Renkert Oil Process Oil Supply

Renkert Oil’s key automotive process oil, Chevron ParaLux 6001, is produced in the USA. In addition to supporting the U.S. auto industry, we import and store ParaLux in Antwerp, Belgium to support auto production in Europe.

This low volatility, non-fogging oil is the standard for interior automotive components like soft-touch TPEs. Our forecasted supply is sufficient and our investment in inventory provides reliable deliveries.

Partner with Us

Today, we are proud to be among the most reliable partners in supply security in North America, Europe, and beyond, with contingency plans at the ready in times of regional instability.

Reach out to learn more about our specialty oil products and what you can expect from a strategic partnership with Renkert Oil.